Benefits of a Corporate Trustee

1. Changing Members

1. Changing Members

If an SMSF is set up with a corporate trustee structure you can add a member (e.g. a spouse or child) or remove a member (e.g. if a member dies or can no longer act as trustee) with much less hassle than an individual trustee structure. If there is a change of fund members, it’s not necessary to change the name on the ownership documents for each fund asset as the trustee of the fund remains the same.

On the other hand, a fund with an individual trustee structure will be required to re-register all assets held in the SMSF (with relevant authorities and registries) each time a member is added or removed. If you have a number of different investments in your fund, this can result in a lot of administration, paperwork, time, and potentially cost, to manage this change. For corporate trustees, the only change is notification to both ASIC and the ATO of the change of directors and members as the name on the assets will be the name of the corporate trustee.

2. Estate planning

An SMSF set up with a corporate trustee can have a single member and director. So, if one member of a two member fund leaves (for example, where either a husband or wife member passes away) and a corporate trustee structure is in place, the fund will continue to satisfy the trustee structure rules. In the case of a two member SMSF with an individual trustee structure, if one member dies, another individual will need to be appointed as a trustee of the fund.

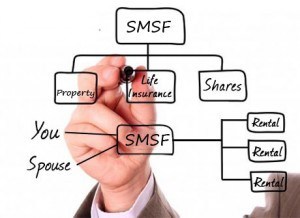

3. Borrowing to purchase property

If you are looking to borrow to purchase property in your SMSF most banks require a corporate trustee arrangement. Banks generally prefer that a separately recognised legal entity is identified as trustee of the fund.

4. Reduced liability

A corporate trustee structure can also provide greater peace of mind around liability. Your personal liability, as a director of a corporate trustee, is generally limited to the assets held within the SMSF. An individual trustee arrangement does not provide this security and members’ personal assets may be subject to liability claims. This could be particularly important for you if you are considering holding property in your SMSF as public liability claims can be substantial.

5. Clarity

Having a corporate trustee makes the separation of assets and income for individuals clearer. This makes it easier to satisfy the regulator that superannuation assets are being separately maintained from the member’s personal assets.

When changing to a corporate trustee, the provisions of the Superannuation Industry (Supervision) Act 1993 (Cth) (‘SISA’), which impose an additional regulatory framework in relation to corporate trustees of SMSF’S, must be considered. Relevant provisions are:

- Under as 17A(1) SISA, all members of an SMSF with a corporate trustee must be directors of the corporate trustee of the fund, and vice versa, each director of a corporate trustee must be a member of the SMSF;

- Under s188 SISA, an individual is not eligible for appointment as a director of a corporate trustee unless they have consented to the appointment in writing; and

- Under s104A SISA, all individuals becoming directors of a corporate trustee of an SMSF must sign a declaration in the approved form confirming that they understand their duties as directors of thee corporate trustee within 21 days after their appointment. The approved form is the ATO ‘Trustee Declaration’ (NAT 71089). This declaration must be retained by the corporate trustee for as long as it is relevant, and in any case for at least 10 years.

Some other relevant considerations that should be borne in mind include:

- A corporate trustee must not be paid for their services as trustee, and no director of the corporate trustee can be paid for their duties or services as a director of the trustee;

- The assets of the fund need to be registered in the name of the company that has been set up to act as corporate trustee; and

- A company established as the corporate trustee will require a company constitution and certificate of registration.

What is required when transferring from a individual trustee to a corporate trustee?

The following steps will have to be taken if you choose to switch to a corporate trustee:

- A company must be established to act as corporate trustee;

- A constitution must be drafted for this company;

- The current trustees must provide the incoming corporate trustee an instrument in writing stating they will be retiring as trustees and the corporate trustee will be assuming duties as trustee at a given date and this instrument being signed by all relevant parties;

- The company must provide a signed consent stating it consents to acting as corporate trustee;

- The directors of the corporate trustee must provide a signed consent stating they consent to being appointed as directors of the corporate trustee;

- The directors must provide the corporate trustee with a signed ‘Trustee Declaration’;

- All assets of the fund must be transferred to the name of the corporate trustee.

Contact us for a Free Consultation

If you have any questions regarding your SMSF, call the experienced lawyers at GMH Legal for a FREE consultation:

Tel: (02) 9587 0458

Email: solicitors@gmhlegal.com

Visit us on Facebook