I DIANA PRINCESS OF WALES of Kensington Palace London W8 HEREBY REVOKE all former Wills and testamentary dispositions made by me AND DECLARE this to be my last Will which I make this First day Of June One thousand nine hundred and ninety three

1 I APPOINT my mother THE HONOURABLE MRS FRANCES RUTH SHAND KYDD of Callinesh Isle of Seil Oban Scotland and COMMANDER PATRICK DESMOND CHRISTIAN JERMY JEPHSON of St James’s Palace London SW1 to be the Executors and Trustees of this my Will

2 I WISH to be buried

3 SHOULD any child of mine be under age at the date of the death of the survivor of myself and my husband I APPOINT my mother and my brother EARL SPENCER to be the guardians of that child and I express the wish that should I predecease my husband he will consult with my mother with regard to the upbringing education and welfare of our children

4 (a) I GIVE free of inheritance tax all my chattels to my Executors jointly (or if only one of them shall prove my Will to her or him)

(b) I DESIRE them (or if only one shall prove her or him)

(i) To give effect as soon as possible but not later than two years following my death to any written memorandum or notes of wishes of mine with regard to any of my chattels

(ii) Subject to any such wishes to hold my chattels (or the balance thereof) in accordance with Clause 5 of this my Will

(c) FOR the purposes of this Clause “chattels” shall have the same meaning as is assigned to the expression “personal chattels” in the Administration of Estates Act 1925 (including any car or cars that I may own at the time of my death)

(d) I DECLARE that all expenses for the safe custody of and insurance incurred prior to giving effect to my wishes and for packing transporting and insurance for the purposes of the delivery to the respective recipients of their particular chattels shall be borne by my residuary estate

5 SUBJECT to the payment or discharge of my funeral testamentary and administration expenses and debts and other liabilities I GIVE all my property and assets of every kind and wherever situate to my Executors and Trustees Upon trust either to retain (if they think fit without being liable for loss) all or any part in the same state as they are at the time of my death or to sell whatever and wherever they decide with power when they consider it proper to invest trust monies and to vary investments in accordance with the powers contained in the Schedule to this my Will and to hold the same UPON TRUST for such of them my children PRINCE WILLIAM and PRINCE HENRY as are living three months after my death and attain the age of twenty five years if more than one in equal shares PROVIDED THAT if either child of mine dies before me or within three months after my death and issue of that child are living three months after my death and attain

the age of twenty one years such issue shall take by substitution if more than one in equal shares per stirpes the share that the deceased child of mine would have taken had he been living three months after my death but so that no issue shall take whose parent is then living and so capable of taking

6 MY EXECUTORS AND TRUSTEES shall have the following powers in addition to all other powers over any share of the Trust Fund

(a) POWER under the Trustee Act 1925 Section 31 to apply income for maintenance and to accumulate surplus income during a minority but as if the words “my Trustees think fit” were substituted in sub-section (1)(i) thereof for the words “may in all the circumstances be reasonable” and as if the proviso at the end of sub-section (1) thereof was ommitted

(b) POWER under the Trustee Act 1925 Section 32 to pay or apply capital for advancement or benefit but as if proviso (a) to sub-section (1) thereof stated that “no payment or application shall be made to or for any person which exceeds altogether in amount the whole of the presumptive or vested share or interest of that person in the trust property or other than for the personal benefit of that person or in such manner as to prevent limit or postpone his or her interest in possession in that share or interest”

7 THE statutory and equitable rules of apportionment shall not apply to my Will and all dividends and other payments in the nature of income received by the Trustees shall be treated as income at the date of receipt irrespective of the period for which the dividend or other income is payable

8 IT is my wish (but without placing them under any binding obligation) that my executors employ the firm of Mishcon de Reya of 21 Southampton Row London WC1B 5HS in obtaining a Grant of Probate to and administering my estate

9 ANY person who does not survive me by at least three months shall be deemed to have predeceased me for the purpose of ascertaining the devolution of my estate and the income thereof

10 IF at any time an Executor or Trustee is a professional or business person charges can be made in the ordinary way for all work done by that person or his firm or company

or any partner or employee

THE SCHEDULE

MY Executors and Trustees (hereinafter referred to as “my Trustees”) in addition to all other powers conferred on them by law or as the result of the terms of this my Will shall have the following powers

1 (a) FOR the purposes of any distribution under Clause 5 to appropriate all or any part of my said property and assets in or toward satisfaction of any share in my residuary estate without needing the consent of anyone

(b) FOR the purposes of placing a value on any of my personal chattels (as defined by the Administration of Estates Act 1925) so appropriated to use if they so decide such value as may have been placed on the same by any Valuers they instruct for inheritance tax purposes on my death or such other value as they may in their absolute discretion consider fair and my Trustees in respect of any of my personal chattels which being articles of national scientific historic or artistic interest are treated on such death as the subject of a conditionally exempt transfer for the purposes of the Inheritance Tax Act 1984 Section 30 (or any statutory modification or re-enactment thereof) shall in respect of any such appropriation place such lesser value as they in their absolute discretion consider fair after taking into account such facts and surrounding circumstances as they consider appropriate including the fact that inheritance tax for

which conditional exemption was obtained might be payable by the beneficiary on there being a subsequent chargeable event

(c) TO insure under comprehensive or any other cover against any risks and for any amounts (including allowing as they deem appropriate for any possible future effects of inflation and increasing building costs and expenses) any asset held at any time by my Executors and Trustees And the premiums in respect of any such insurance may be discharged by my Executors and Trustees either out of income or out of capital (or partly out of one and partly out of the other) as my Executors and Trustees shall in their absolute discretion determine and any monies received by my Executors and Trustees as the result of any insurance insofar as not used in rebuilding reinstating replacing or repairing the asset lost or damaged shall be treated as if they were the proceeds of sale of the asset insured PROVIDED ALWAYS that my Executors and Trustees shall not be under any responsibility to insure or be liable for any loss that may result from any

failure so to do

2 (a) POWER to invest trust monies in both income producing and non-income producing assets of every kind and wherever situated and to vary investments in the same full and unrestricted manner in all respects as if they were absolutely entitled thereto beneficially

(b) POWER to retain or purchase as an authorised investment any freehold or leasehold property or any interest or share therein of whatever nature proportion or amount (which shall be held upon trust to retain or sell the same) as a residence for one or more beneficiaries under this my Will and in the event of any such retention or purchase my Trustees shall have power to apply trust monies in the erection alteration improvement or repair of any building on such freehold or leasehold property including one where there is any such interest or share And my Trustees shall have power to decide (according to the circumstances generally) the terms and conditions in every respect upon which any such person or persons may occupy and reside at any such property (or have the benefit of the said interest or share therein)

(c) POWER to delegate the exercise of their power to invest trust monies (including for the purpose of holding or placing them on deposit pending investment) and to vary investments to any company or other persons or person whether or not being or including one or more of my Trustees and to allow any investment or other asset to be held in the names or name of such person or persons as nominees or nominee of my Trustees and to decide the terms and conditions in every respect including the period thereof and the commission fees or other remuneration payable therefor which commission fees or other remuneration shall be paid out of the capital and income of that part of the Trust Fund in respect of which they are incurred or of any property held

on the same trusts AND I DECLARE that my Trustees shall not be liable for any loss arising from any act or omission by any person in whose favour they shall have exercised either or both their powers under this Clause

(d) POWER to retain and purchase chattels of every description under whatever terms they hold the same by virtue of the provisions of this my Will And in respect thereof they shall have the following powers

(i) To retain the chattels in question under their joint control and custody or the control and custody of any of them or to store the same (whether in a depository or warehouse or elsewhere)

(ii) To lend all or any of the chattels to any person or persons or body or bodies (including a museum or gallery) upon such terms and conditions as my Trustees shall determine

(iii) To cause inventories to be made

(iv) Generally to make such arrangements for their safe custody repair and use as having regard to the circumstances my Trustees may from time to time think expedient

(v) To sell the chattels or any of them and

(vi) To treat any money received as the result of any insurance in so far as not used in reinstating replacing or repairing any chattel lost or damaged as if it were the proceeds of sale of the chattel insured

(e) POWER in the case of any of the chattels of which a person of full age and capacity is entitled to the use but when such person’s interest is less than an absolute one

(i) To cause an inventory of such chattels to be made in duplicate with a view to one part being signed by the beneficiary for retention by my Trustees and the other part to be kept by the beneficiary and to cause any such inventory to be revised as occasion shall require and the parts thereof altered accordingly

(ii) To require the beneficiary to arrange at his or her expense for the safe custody repair and insurance of such chattels in such manner as my Trustees think expedient and (where it is not practicable so to require the beneficiary) to make such arrangements as are referred to under paragraph (iv) of sub-clause (d) of this Clause PROVIDED THAT my Trustees shall also have power to meet any expenses which they may incur in the exercise of any of their powers in respect of chattels out of the capital and income of my estate or such one or more of any different parts and the income thereof as they shall in their absolute discretion determine AND I FURTHER DECLARE that my Trustees shall not be obliged to make or cause to be made any inventories of any such chattels that may be held and shall not be liable for any loss injury or damage that may happen to any such chattels from any cause whatsoever or any failure on the part of anyone to effect or maintain any insurance IN WITNESS whereof I have hereunto set my hand the day and year first above written

SIGNED by HER ROYAL HIGHNESS )

in our joint presence and )

then by us in her presence )

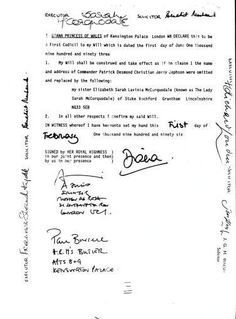

I DIANA PRINCESS OF WALES of Kensington Palace London W8 DECLARE this to be a First Codicil to my Will which is dated the first day of June One thousand nine hundred and ninety three

1. My Will shall be construed and take effect as if in clause 1 the name and address of Commander Patrick Desmond Christian Jermy Jephson were omitted and replaced by the following:

my sister Elizabeth Sarah Lavinia McCorquodale (known as The Lady Sarah McCorquodale) of Stoke Rochford Grantham Lincolnshire NG33 5EB

2. In all other respects I confirm my said Will.

IN WITNESS whereof I have hereunto set my hand this First day of February One thousand nine hundred and ninety six

SIGNED by HER ROYAL HIGHNESS )

in our joint presence and then )

by us in her presence )